Improving product and customer profitability

A company manufacturing and exporting equipment for the iron, steel, glass and chemical refining industries was heavily hit by the effects of the strong pound. Rapid action was required to protect profitability, without jeopardising the significant market share and excellent customer service levels the company had achieved. At this time of crisis, managers realised that existing management information offered limited support to the urgent commercial decisions they faced. Yet within four months, the company had defined the information that mattered, collected the necessary data, and announced an immediate £0.75million improvement to the bottom line, cost reduction initiatives amounting to 20% of central overhead, a revision to the planned £4.5million investment so it was better focused on profit making products, and a lift in sales of profitable products.

The turning point in resolving their problems came when managers realised that despite their success so far, they were unable to answer some fundamental questions.

- Who are our most – and least – profitable customers?

- Which are our most – and least – profitable products?

- Can we be more price competitive on certain products?

- Which industries and regions should our sales force focus on?

The management accounts were split into legal entities, of which the company had several. There were no means of allocating overheads – 14% of total costs – in any meaningful manner to sales regions, products or customers. The resulting management information was known to provide an incomplete picture.

Something more was required. A project was set up to expose the true profitability of regions, products and customers, using the techniques of activity based costing (ABC).

Customer Profitability made visible

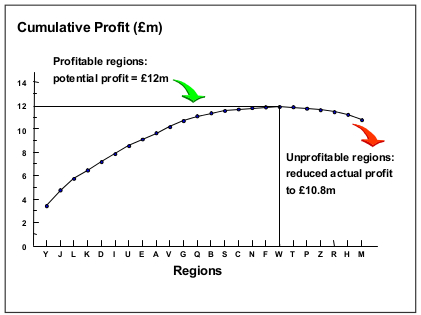

The project’s first result was an analysis of regional profitability (see figure right).

Region M, the Middle East, proved to be the biggest loss-maker of all. The company already knew the region was trailing the competition in developing customer relationships. Managers had begun to suspect that the resources committed to Region M were not justified by prospects for business growth. Activity-based costing techniques provided the incontrovertible cost evidence they needed to shut the regional office down and deliver an immediate improvement of £0.75 million to the bottom line.

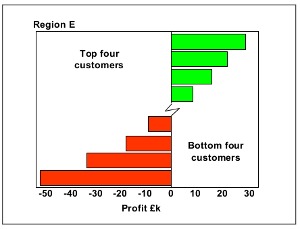

Region E, Eastern Europe, was profitable but performance was slipping. Detailed data analysis (see figure left) showed that total losses from the bottom four customers outweighed the profit made from the top four.

To get a foothold in Eastern Europe, the company had depended on agents, whom they regularly targeted with substantial sales drives and high levels of commission. However, as business in Eastern Europe expanded, agents took the chance to represent the interests of more and more companies, many of whom were competing in the same markets.

The customer profitability analysis triggered a rapid overhaul of business practices. Trading through agents ceased and a dedicated, salary-only sales force was recruited. Agent commissions vanished, sales spend halved and levels of business from each of the ‘problem’ customers revived.

Product profitability made visible

Managers knew that the primary steel processing segment of their business accounted for a healthy profit. However, the highly-prized product groups in that segment were losing money, not making it.

Products and Turnkey Systems in the segment had each been judged profitable, though for different reasons - Products, because of costs; Turnkey Systems, because of the premium price charged for customised construction and assembly.

For Products, the company had prioritised volume growth and invested considerable sales resource to achieve it. Unfortunate consequences ensued - sales people cut prices to achieve target volumes, even when there was no competition.

With Turnkey Systems, both customers and sales people demanded high levels of technical support. An army of specialist engineers, each covering a narrow field of expertise, was on hand to supply it. The impact on profit of price-cutting in the one case and engineering support in the other was not visible in the management accounts.

Benefits demonstrated by using ABC analysis

- Knowledge of true customer and product profitability

- Better-informed strategic and commercial decision-making

- Short-term cost saving opportunities on controllable overhead costs

- Strategies to reduce those costs which do most to erode margins

- Improved business process performance

The activity-based management results challenged the way in which the Sales Department planned business and deployed resources. Sales activity was redirected to focus on high ‘net’ margin opportunities. Technical support became a service for which customers paid, provided by fewer engineers, each covering a broader range of expertise. Technical training for sales staff was improved.

An unexpected side-effect of the project was the use of management time. Sales Managers, previously sucked into handling key accounts - what they liked doing best - realised they had to channel much greater effort into managing the business.

Finally, the company revised the investment in additional manufacturing capacity. This decision was made when managers were confident that the products were profitable and that the market place will sustain that profitability for some time to come.