Improving product & customer profitability, and reducing costs

A Prepared Foods manufacturer believed it was doing reasonably well with an overall 40% gross margin and profits of 10%. Not bad, considering its customers were major supermarket chains who demanded safe, fresh, consistently high-quality products delivered to extremely tight schedules day after day. Customers also expected such services as proactive product review and innovation, sourcing of new and exotic ingredients, new ways of presenting and packaging products, 24x7 services, and so on.

The company thought it had financial control through accurate measurement of direct costs and gross margins. But management was concerned to discover that as volumes rose so did overheads – and sometimes at a faster rate. Meeting its growth and margin targets meant uncovering where processes were failing, and understanding which features of the customer relationship were losing money.

The company found that, in order to meet the increasingly complex service demands from customers, internal processes had grown complex. This complexity caused additional overhead costs, eroding profitability, as was clear from the bottom line of the company accounts. What was not clear was the impact on individual product and customer profitability. So management could not see where they could improve efficiency without damaging customer service.

Identifying product and customer profitability

Salvation came in the form of a detailed profitability analysis that showed that only 50% of the company’s 200 products made money. Simply getting the 50% that lost money to break even would add 25% to the overall profit!

Breaking down the analysis into the products for each of their major supermarket customers, as shown in the figure (see right), gave an even more interesting picture.

Taking each customer in turn, the net profit associated with each product that the customer bought was calculated.

The list of products was then put in a sequence so that the most profitable was first, the second most profitable was next, and so on. The cumulative profit provided by this sequence of products was then plotted, one curve for each customer.

It became immediately clear that some products made a handsome profit, while most contributed next to nothing or made a loss.

Breaking down the analysis by production line and also into specific characteristics of each product such as ingredients, order quantities and type (standard or promotion) revealed the causes of the low or negative profitability.

Some causes were obvious: low volume runs require high indirect activity on changeovers; high labour usage on less automated lines; high raw material wastage.

But other causes were more subtle: the number of production line re-plans during a day; the minimum order quantities for certain ingredients; unique packaging and printing for promotions; running promotions for an elapsed time rather than for a given volume; erroneous standard costings of certain in-house manufactured ingredients; poor integration of planned maintenance and consequent high numbers of breakdowns; hidden costs of unnecessary variety.

Identifying and fixing business process problems

Some processes were found to be key to profitability both because of how they were performed and because of the decisions and actions they prompted.

In order to understand how each process worked in detail, it was physically walked from beginning to end, and a map was drawn.

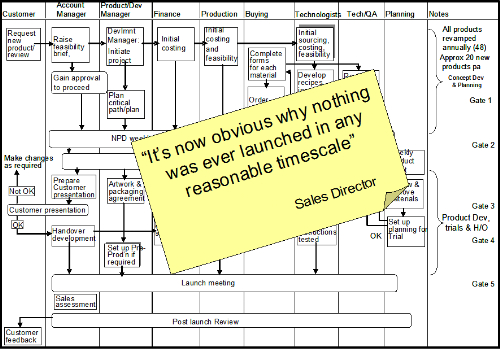

A typical map, (shown right) for NPD, highlighted just how complicated the business had become. The map immediately began to prompt ideas for simplifying the process.

Bringing together people who were linked tightly by a process uncovered the significant waste due to regular process failures. Once the level of waste was acknowledged and quantified, the collective brainpower of everyone involved was focused on making the process better.

The analysis and improvement steps were repeated for other key processes.

An immediate benefit was an opportunity to reduce costs by around 25%. Later came improved relationships with customers because the company now knew where to devote resources to enhance the relationship to mutual benefit.

Equally it knew where to cut back on service levels where no value was added and no degradation in perceived customer service occurred.

Taken together, the profitability analysis and the process improvements grew net margins by almost 50%.