Improving product profitability and competitiveness

A power generation equipment manufacturing business had ambitious plans. Production capability was enhanced, it reorganised into high-tech machine cells, a number of new markets were opened up and a partnership deal with a third party seller gained access to some lucrative new business opportunities.

Unfortunately, as a particularly deep global recession began to bite, its competitors proved much nimbler, and the order book became perilously weak.

What had appeared sound capital investments only a few years before, now showed a poor return. The business decided that its response would be to ‘double the business’ within two years. However, the new MD was adamant that this had to be profitable business, achieved without increasing headcount, problems or lead times.

Within six months the company identified process improvement to increase overall capacity by 25%. By analysing product profitability, it decided to enhance its standard products resulting in fewer ‘specials’ made to customer order. By analysing customer profitability, it was able to modify its channels to market and revise the mix of customers.

The result? A much more profitable mix of products, channels and customers, which doubled profitability. A position that delighted the parent company and shareholders alike.

The problems

The problems faced by this company are common to many engineering companies:

- No real knowledge of which products and customers were really profitable - only a suspicion that some were, at best, marginally profitable Product costing calculated by using an overhead recovery rate (ORR) based on the 10% of costs represented by direct labour was the primary cause of major distortions. Many manufacturing companies still use the ORR method even though their overheads have become a major proportion of total costs.

- A bid-to-order success rate of only 1 in 10 - high selling costs incurred because the business had no knowledge of where best to focus its resources. When lean times come and customers are hard to find, every enquiry is treated the same way in the belief they will all turn into orders.

- Nearly every order was a 'special', even though the company had designed and promoted a standard range of products. As a result, Engineering was involved in every order, consistently resulting in missed delivery dates.

- No costing information to inform sub-contracting decisions - as a result, internal facilities were poorly-utililised while there was a high level of overall sub-contracting. The costing calculation pooled all overheads into the production hourly rate, which provided an erroneous basis to compare sub-contractors prices.

- Frequent programme changes due to shortages. Attempting to slot orders into gaps in the production schedule for parts and sub-assemblies created re-runs of the MRP system. Pulled-forward demand now created 'shortages' which in turn drove new programme changes. Instability was built into the scheduling system.

- High levels of both inventory and obsolete stock. Inventory was the final measure of many process failures. Programme changes created unwanted stock, previously made for earlier scheduled orders. Production turned raw material into unwanted parts in order to 'clock up' their targeted overhead recoveries. Early cut-in dates of value engineered parts created out of specification stock. Parts made to forecast where orders later failed to materialise.

- Excessive waste, rework and duplication arising from process failures. Every current month felt like chaos theory at work even though the following months seemed as if they would be stable. As delivery dates drew near, pressure increased to ship part-finished assemblies so invoices could be raised. Additional premium rate costs to finish assembly at the customer's location were then buried in the accounts.

Using ABC to gain real knowledge

Using a multi-functional team, activity data from every department was collected and categorised into its

basic 'core' activities - those that add value in some way - and 'diversionary' activities - those that merely

dissipate value.

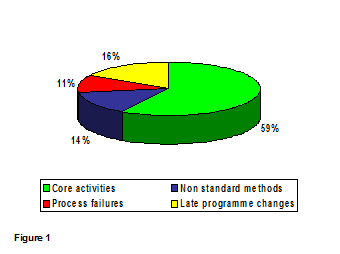

Failure costs in the 'Contract execution' process alone amounted to 41% (see Figure 1)

Using a multi-functional team, activity data from every department was collected and categorised into its

basic 'core' activities - those that add value in some way - and 'diversionary' activities - those that merely

dissipate value.

Failure costs in the 'Contract execution' process alone amounted to 41% (see Figure 1)

An understanding of these costs and their magnitude provided a vital focus for process improvement.

When an ABC model of the business was built, real knowledge at last highlighted some solutions to the problems.

In the key process of responding to around 300 tender requests in a particular product/market segment, 230 were unsuccessful. A process cost of nearly £2m per annum of highly skilled engineers' estimating time included almost £500k of wasted effort! The ABC data provided superior product cost data in a form that gave them a simplified modular pricing mechanism. Not only did this save estimating time, but it provided an essential focus to only respond to those tender requests where the chances of winning were higher.

In manufacturing, the cost rate per hour had included all the overheads recovered on direct hours. As the direct labour costs were only 10% of total costs, this had created a serious distortion in the costing formula. Knowing the real costs in production was a revelation, but the true benefit came when the cost base was reduced. ABM provided the focus to tackle the key high costs and their causes.

The distortion in product costing had also infected the calculations for capacity planning. All the previous numbers indicated that a high proportion of production had to go to sub-contractors at premium rates. In the production areas people stood idle. The ABC results underwrote something the unions had been pointing out for some time; the company was exporting jobs to other companies!

From the customer profitability analysis, a number of customer types were found to be at an uncomfortable level

of profitability.

Some customers were dropped, while a number of others were handled through a less costly channel.

The overall sum of the margins now started to look healthier once nearly £1m of avoidable customer

related costs were eliminated.

From the customer profitability analysis, a number of customer types were found to be at an uncomfortable level

of profitability.

Some customers were dropped, while a number of others were handled through a less costly channel.

The overall sum of the margins now started to look healthier once nearly £1m of avoidable customer

related costs were eliminated.

However, a major jump in profitability came when the root causes of diversionary activities were identified and the process improvements implemented. The additional capacity this provided allowed the increased volumes of profitable products, sold to profitable customers to be processed at lower levels of unit costs. In the first year the reduction in costs through reducing contractor premiums and the activities of handling contractors provided another £1.5m to the bottom line.

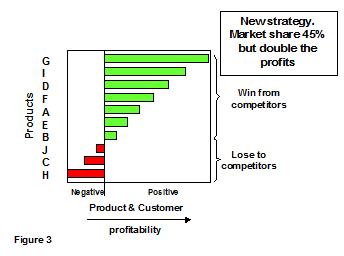

The ABC analysis provided an insight into how the company could increase market share while at the same time create a negative impact on their competitors. This was using ABM to make a strategic strike at competitors.

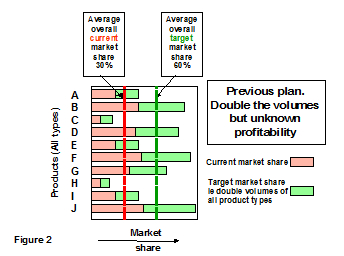

The previous plan, as shown on figure 2, was to increase market share across all the products

to all the types of customers. In other words, just go for volume.

The previous plan, as shown on figure 2, was to increase market share across all the products

to all the types of customers. In other words, just go for volume.

With the knowledge from the ABC analysis the company now knew the product & customer mix where it did not want to win contracts. (see Figure 3)

However, by entering into a competitive tendering situation and forcing down the price, it knew exactly when to let a competitor win the bid knowing that the competitor would now have an order that would be at a breakeven or loss making price. Had the company just refused to bid, a competitor may have been left as the only contender, selling at a high price.