Product profitability analysis rationalises distribution network

The new owners of a specialist distributor provided a tough challenge to the management team – improve return on capital from a meagre 6% to 18%, equivalent to a tripling of profits!

Further challenges included: retailers seeking bigger discounts, better stock availability and more technical support; robust competition forcing the business to work hard just to hold on to their retail channels; suppliers insisting the business stocked and distributed a very broad product range from items costing a few pence to thousands of pounds.

The business operated several warehouses located around the country. Only its largest suppliers delivered product to all warehouses. The smaller suppliers delivered to the most convenient warehouse to them and the business balanced its inventory by moving stock around the warehouses.

The cost of multiple inventories

The turnaround came when their activity based costing analysis revealed the true cost of balancing inventory around the warehouses. For every £1 the company spent on the activities of purchasing, paying suppliers, receiving and storing incoming goods, it spent a further 41p on moving stock from warehouse to warehouse. Despite the balancing process, it was still frequently necessary to express goods to customers at the other end of the country, at further cost.

Within three months, the company had plans in place to carry all their stock in a single warehouse. This, plus other improvements, allowed the business to reduce overheads by over a third, while actually improving availability and speed of delivery to customers.

Maintaining the links to customers

Moving to a single warehouse structure naturally forced a major rethink of logistics. The old warehouse locations enabled the company's own delivery vehicles to make round trips covering twenty or so retailers in a day. As well as providing the "personal touch", this method had been frequently benchmarked against contract haulers and courier companies, and found to be more cost-effective. Couriers continued to be used to reach more distant retail customers. How would this change, what were the cost implications, and how would customers react?

For many customers, nothing has changed. Improvements in the motorway network have brought many new retailer locations within the "one-day radius" of the surviving warehouse. A further band can be reached through a relay technique: early every morning a driver from the warehouse hands over a full vehicle to a local driver and drives yesterday's empty one back.

The cost impact of switching the more distant customers from own-fleet to courier delivery has been largely offset by the reduction in emergency shipments, most of which were sent by courier in the past.

The sales force continues to have national coverage, though most are now based at home rather than the nearest warehouse. The typical agenda of a customer call has changed; from chasing late consignments to stock planning for new products and the new season.

The impact on people’s valuable time

As well as eliminating the need to transfer stock between warehouses, the restructuring had a significant impact on several other activities. The staff identified potential savings from eliminating a host of diversionary activities. For example, dealing with late deliveries during sales visits to customers proved to be the most significant. In this case the management chose not to reduce the sales team by 50%, but instead set new sales-related priorities for the additional time now made available.

Tackling the problem of returned goods

Returned goods were another drain on people's time. Prior to the activity analysis project around 20 per cent of order items were returned, and this was generally assumed to be the norm in this specialist sector, given the technical nature of the products. When the cost of handling returns was found to match or exceed the value of the goods handled, there was a clear need to understand why goods were returned.

The principal cause proved to be not product failure, but customer behaviour - some large retailers were deliberately over-ordering. There were two main causes for over-ordering:

- Unreliable supply

- Sales promotions by the distributor to encourage retailers to buy in stock - unfortunately these were not complemented with promotions to end-customers.

Both of these causes could now be addressed by the distributor, without the need to "take a stick" to errant retailers.

However, it was also believed that some retailers were over-ordering speculatively, on hearing rumours of impending shortages and price rises, or at the end of a sales promotion. Goods bought at a lower price could later attract a higher refund. This was effectively eliminated by a new bar-coding system introduced to the sole warehouse.

New deals with suppliers

There were hundreds of suppliers, but half of them eroded profits by 7% while only generating 3% of total sales. The greatest losses were "achieved" through handling small parts and spares. Not only did these carry high handling costs for negligible margins, but also frequent shortages generated additional diversionary costs as the business chased back-orders to meet customer demand. Eliminating unprofitable suppliers could in theory reduce inventories.

However, there were also options for turning unprofitable supplier relationships around. Supplier profitability was actually improved in a variety of ways.

- The lowest-volume suppliers were simply "rationalised out", especially where they competed with another supplier.

- Some suppliers are now financing additional stock levels of low value and spare parts. In effect the distributor's warehouse becomes an extension of the suppliers' finished goods stores. Both parties save through a reduction in panic orders.

- Some suppliers of low-cost, high-margin goods have agreed to reimburse for unsold goods, taking the lead from the newspaper industry. The distributor and retailers can now carry higher stocks without financial risk, and all parties are sharing the benefits of higher sales volumes.

Managing inventory costs

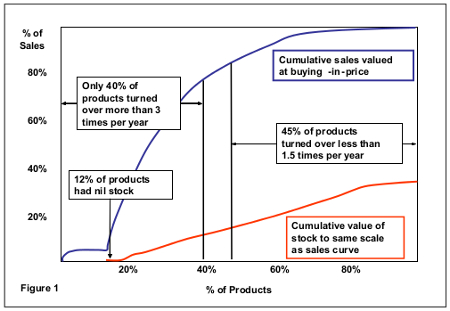

The improvement in ROCE was achieved not only through improving profits, but also through reducing the capital employed, much of which is tied up in inventories. A spot check at the outset of the project revealed some areas of concern, as shown on figure 1 (see right).

Products were ranked by turnover frequency, the slowest to the right. Overall the stock turned over 3 times per year. 45% of products, representing only 10% of sales, turned over at half this rate or less. Yet 12% of product lines, representing 5% of sales, were out of stock at all warehouses.

Amalgamating the warehouse stocks reduced the effect of random variability of demand, and thus the need to keep such high inventory levels. However, the greater part of the saving has been through closer monitoring of demand patterns and suppliers' plans for updated designs, so that stocks of obsolescent lines are now run down earlier without the need for heavy discounting.

A major cause of stock-outs has also been eliminated: the sheer complexity of the ordering algorithm.

Managing supplier quality

Some of the more complex, higher-margin products have proved to be less profitable than expected due to failure in service, even when caused by end-customer misuse. This results in activities such as claim-handling, obtaining and supplying warranty spares, unpaid servicing and repairs, fault investigation and communication to reassure the end-customer community.

Knowledge of these costs has motivated the distributor to engage in robust discussions with certain suppliers. The aim is to eliminate all potential causes of such failures.

Benefits from the ABC analysis

Above all, the study showed that players in the middle of a supply chain do not have to regard themselves as squeezed from both sides – they just have more parties with whom to negotiate. Success in this field depends critically on being well-informed.