Rolling forecasts have been around for a long time. They may not have always been known by this name, nevertheless for over 50 years organisations have regularly looked ahead over a constant period of time with what today would be called a rolling forecast. Despite its long history the rolling forecast has been the subject of a recent surge of interest. In one survey of budgeting practice in UK corporations, 40% of the finance managers who responded had already implemented a rolling forecast or were giving it some careful thought. To respond to this interest in the subject the ICAI has commissioned a one day Mastercourse entitled 'the rolling forecast as a catalyst for change', to be held twice a year. This article attempts to explain what a rolling forecast is and how it can be a catalyst for change in organisations.

A rolling forecast is a forecast for sales, or for costs, but more often than not for both, that always extends a set number of financial periods into the future. The term 'roll' refers to the regular update that takes place - typically monthly or quarterly: the forecast horizon is extended so that the number of periods included remains the same; figures are entered for the new periods at the horizon; and all the figures already in place from earlier forecasts are updated.

There are two main reasons for interest in rolling forecasts. The first relates to the budget - in particular its value as a forecast.

Ironically budgets are normally put together with a great deal of care and attention. It often starts with a strategic review and a longer term plan over, say, five years. Each organisational group, divisions down to departments, is then asked to produce a detailed forecast for the forthcoming financial year for sales, costs and capital.

Once agreed, the budget becomes a statement about resources needed and any revenue that will be raised. For some organisations it serves as no more than a guide. But in many it is represents a personal contract between manager and employer. Let costs exceed the budget, or fail to raise the requisite sales, and bonuses are at stake, if not jobs.

Unfortunately, despite the attention it gets, the budget is rarely an accurate forecast. As a result, once into the new financial year, many organisations operate a separate forecast, just to the end of the year. This forecast is important for indicating just how wide of the mark the outcome will be - of interest to those with pay and reputation on the line.

A rolling forecast helps lift the blinkers put in place by the budget. It focuses attention beyond the annual finishing line, frees up managers' thinking and prompts them to look at risks and opportunities further into the future.

The second reason relates to the use of performance measurement frameworks such as the balanced scorecard. Organisations are setting goals for KPIs that may stretch several years into the future. A mission to, say, 'become the customer's first choice for pizza' drives the choice of KPIs which will indicate whether they are on track to reach this goal.

The forecast is a safety check. If, in order to influence certain KPIs, new facilities are being built to boost service levels for pizza delivery, the forecast should give early warning of any risks emerging not anticipated when the venture was planned.

When planning a rolling forecast it is worth reflecting upon one that everyone is familiar with - the weather. It presents us with some interesting characteristics that we accept without question. The first is integrity. We assume that it has been updated recently, and that it reflects all that there is to know about the influences upon our weather. If it turns out to be wrong, we accept that it was down to something unknown or unpredictable.

The second is trust. If the forecast suggests bad weather ahead we don't normally ignore it, or seek a second opinion. We get the umbrellas out.

Bear those points in mind when considering the rolling forecast operated by a UK manufacturing company that makes small electronic components for a range of industries. The forecast is maintained in a spreadsheet. The first column contains a list of several hundred parts. The columns thereafter contain forecasted volumes out to a 15 month horizon.

Somewhat strangely the volumes for many parts vary for the first few periods but then settle out at a single number for the remainder of the forecast. This is the case even for parts that are fitted to devices that have a pronounced seasonal pattern of demand.

This forecast was the creation of the finance function. Under pressure to find an alternative to the budget, the Finance manager issued an edict to the sales and marketing team that they would now be responsible for the sales figures in a rolling forecast. It would be refreshed monthly, and the latest numbers would be needed by the last Friday in the month.

It's not hard to imagine the scenario. It's 4pm on the final Friday of the month. The email with last month's forecast has been sitting in the Sales Manager's Inbox for a week, waiting to be updated. When the spreadsheet is opened, last month's numbers are in place but there is now a new, and blank column furthest to the right. What is the easiest, perhaps the only thing that the manager can do in the remaining hour of that Friday? They copy into the blank column the number one to the left of the blank column, and they then make some adjustments to the periods that they know best - the three or four immediately ahead.

Of course the weaknesses have been apparent to all. So, whenever the senior management team needs information to present to investors they use some parts of the budget, some parts of the forecasts, and the rest they make up themselves.

It takes time to build a rolling forecast that has integrity and the trust of those who use it. One of the most striking examples is to be found in a manufacturing organisation that has its headquarters in the US and manufacturing operations dotted around the world.

Avon Automotive makes automotive components. They range from hoses for fluids to vibration mounts for engines. Most of the production goes to the automotive Original Equipment Manufacturers (OEMs), e.g. Ford and General Motors. However, they also supply to other component manufacturers who either include Avon's parts within their sales to the OEMs or sell them on to yet another component supplier.

They operate a rolling forecast for sales and expenses that has a five year horizon. The sales forecast, which is refreshed monthly, can be broken down to individual part number.

It was the limitations of the budget that moved Avon to adopt a rolling forecast. When budgeting, Avon's sales managers had to know which vehicles each of several thousand parts was fitted to. They also needed to know about the demand for those vehicles, and about any decisions to change or replace them.

Despite months spent putting this together, once into the new year, the sales and PBIT forecasts to the year end would quickly show a variance against the budget - usually negative. As time passed, managers would have to struggle hard to recover the situation, leading them to miss or ignore opportunities further ahead.

The rolling forecast had to be more than just a safety report. Working in such competitive markets Avon needed something to offer them a competitive advantage - warn of threats and opportunities as far ahead as possible, and then be a guide about how to react. It would need to be refreshed frequently and contain as much detail as the budget.

The Finance team avoided the trap of deciding how it would work and then issuing an edict to the rest of the business. To work, it needed the full engagement of the sales and marketing people who built the budget - and they stipulated some conditions that were instrumental in building the integrity and trust necessary for the forecast to make a difference.

A key customer for the forecast had to be the sales team themselves. If it gave them new information then ongoing maintenance and development would be in their interest. If it was to be just a regular restatement of what they already knew, then it wouldn't happen. That meant the forecast needed to be:

For these criteria to be met, they knew that information from outside the business would be essential - ideally a forecast for vehicle builds to drive the forecast for their parts. It had to be good enough to warn the sales team of trouble ahead - down to the level of individual part numbers. Time honoured forecasting practices such as extrapolating history and then applying some best guesses about the market were not going to be good enough. Avon eventually found such a forecast. The service provides forecasts for vehicle and power-train build volumes for all OEMs globally. Within their own bespoke forecast system Sales Managers link each part with its host vehicles. Then, whenever the vehicle forecast is imported, the forecast for each part is updated. Sales Managers also enter 'prospective' parts. This is future business to be pursued - and is colour coded according to the current state of development combined with the chance of success.

The output is then turned into revenue and expenditure forecasts by the finance team.

It took much encouragement from the Chief Executive to release the first forecast - the news wasn't good. Traditionally bad news was always groomed to make it look better before it reached the Board. But on this occasion it was released 'warts and all', and Avon had their first honest and information based forecast. Since that day they haven't looked back:

In other words, the rolling forecast has now replaced the budget as the central management tool.

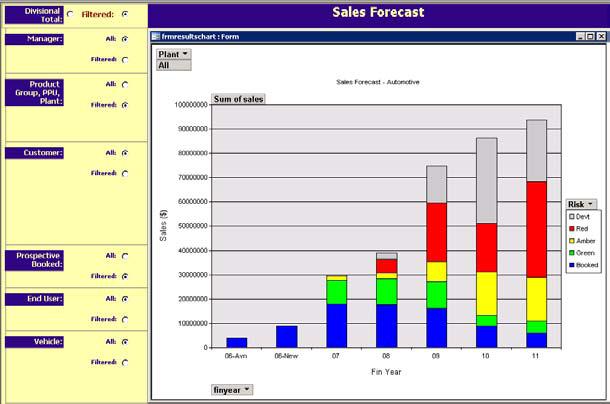

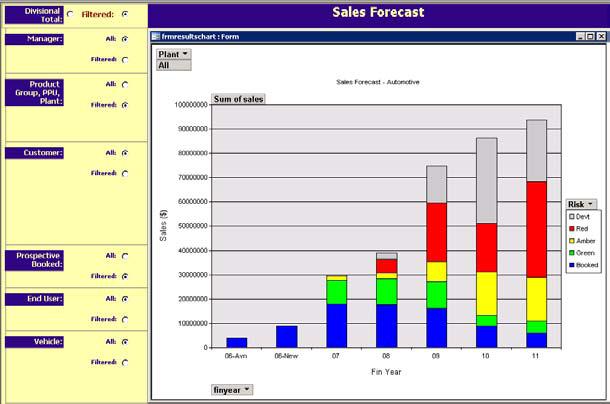

The community of maintainers and users now extends across the organisation. For many, maintenance and use have become integrated into a single activity. The content and the output from the forecast therefore never stand still but are growing with the needs of the community. One output from the forecast is shown below.

An example of a sales forecast for one of Avon's plants. The blue shows confirmed business, the remaining colours show the business up for grabs in the market and the chance of winning it.

So, whether a forecast is going to be a quick safety check, or something more substantial aimed at challenging behaviour, there are some criteria that are worth striving for.

Fulfilling these criteria will never be an easy task. But if they are, and a storm is forecast, then there's a good chance that the umbrellas will go up a little bit earlier.