Customer profitability equals Revenue less the visible & hidden costs of the relationship. The visible costs are easy to find, they are on the ledger. But the real customer profitability can stay hidden deep in the business. So understanding all the costs that CRM drives is vital to knowing which customers are profitable or not, and why.

Technology rushes on. Now you can record and process all available facts about your customers. You can log their every purchase and preference. You can store details of each transaction and interaction, be it through call centre, e-mail or post. If customers visit your web site, you know their every key stroke and click. If your marketeers have got it right, you can predict customers' every need and anticipate their every whim.

Web routings, pages and menus can be programmed to reflect the history of the viewer and the actions they take on-line. Just as good salespeople, but at a fraction of the cost, you can package and price offers not to target a niche, but an individual. Buying decisions become quicker and easier because customers are propositioned only with what they find attractive, in a process they judge convenient, safe and painless. And on top of all this, sales costs plummet as the need for expensive salespeople and high street outlets, and for low turning showroom stock, disappears.

So where's the catch?

In fact there are two. The first is that all your competitors will be doing the same thing. So unless you can take an early lead and then defend your additional market share, or unless the concoction of technology and marketing that CRM represents increases the size of the total market, your only hope is to do it better than your competitors. This is what you try to do every day.

The second catch is that all the hyperbole about CRM usually has a different message to the customer. It says lower prices. So instead of being able to pass on to the customer the cost of all the expensive technical wizardry, you find that margins are squeezed even more!

So is CRM merely a development in which you are forced to participate as a defensive measure, to the benefit only of customers and to ward off competitors? Not necessarily. CRM is aimed at capturing information that will allow you to create the circumstances in which customers will buy. It maximises the attractiveness of the offer and the convenience of the sale by matching the products and the selling process to the right customers. But in making the match it risks driving hidden costs into the business, be it by shortening delivery lead times, by encouraging complex product variants, by offering high levels of personal service, or by attracting customers whose behaviours trigger excessive and largely hidden costs.

CRM needs to anticipate every interaction the customer might have with the business, before, during and after the sale - and to cost it. Identifying customer revenue is easy: it's called the sales ledger; but when the dust has settled on the new CRM implementation the real customer profitability stays hidden deep in the business. So understanding all the costs in the business right down to supplying and servicing each and every customer is vital to setting the rules around 'good' and 'bad' customers and the prices that you offer.

A clear understanding of customer profitability allows your business to differentiate the level of service it provides to various customer segments according to their needs and their value to the company. For example, you may offer higher service levels to prized customers in the form of dedicated telephone lines, more individual attention, incentive pricing or customised products. At the same time, you might choose to reduce service to unprofitable customers or increase prices.

Even let unprofitable customers drift to competitors - if they are measuring only sales and gross margin they will never know that you have burdened them with additional losses.

A comprehensive view of the costs that customers drive allows a business to refine its CRM policies and focus its resources where they will have the greatest effect on profits: cementing relationships with the right customers; avoiding excessive costs; matching prices to the service given.

In many sectors the customer continues to provide revenue and to drive costs well after the initial sale, through after-sale service, repeat purchasing or general administration. All these costs, as well as the revenues, need to be identified and analysed if you are to ensure that the initial terms are profitable and that the customer segments you target have a high probability of being profitable over the lifetime of the relationship.

The fundamental task is two-fold. Firstly, the unit costs of activities in the business need to be identified and related to internal processes. Secondly, customer interactions need to be captured from all the various systems in the company in which they reside. Linking these two sets of data enables a picture of customer profitability to emerge. It is a picture, once drawn that can be viewed either at the level of individual customer or at whatever level of customer segmentation you define. Completing this whole task is at the heart of undertaking an Activity Based Management (ABM) project.

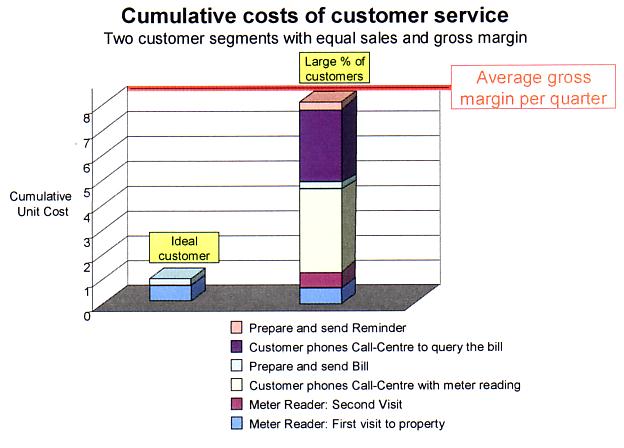

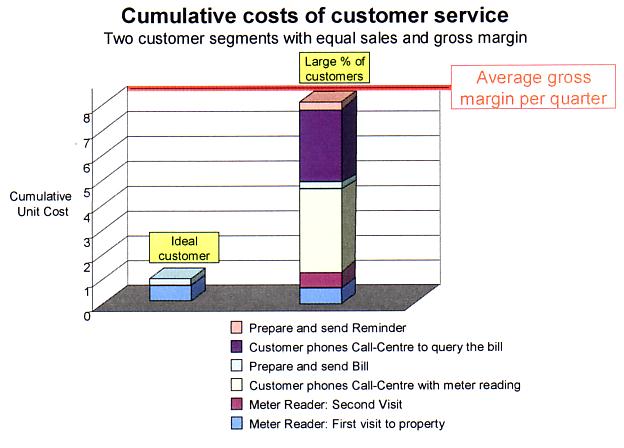

A typical ABM output from a Utility is shown in the diagram below. It reveals that a customer doesn't have to be a rogue to be unprofitable - too many interactions with the business soon wipe out profits.

And when an analysis of the real profitability of every customer is undertaken a universal law of business is always revealed - not all customers are created equal in the sight of the supplier. They behave differently from one another and have a variety of characteristics, so they generate different costs and net margins. Some are highly profitable, others are spectacularly unprofitable, and many lie in-between.

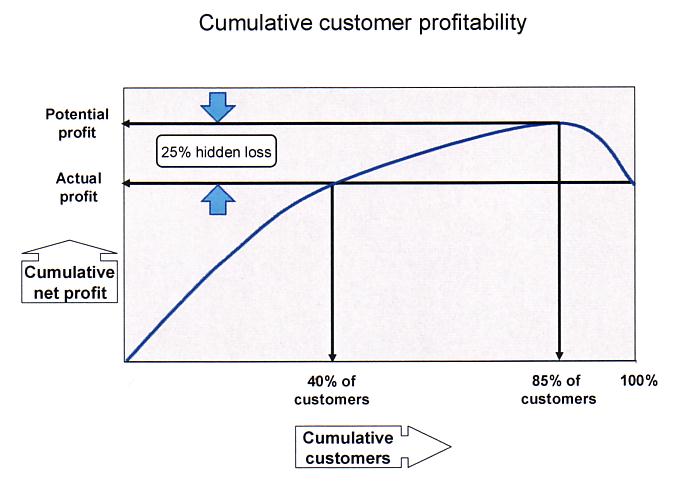

Another typical ABM output from a Utility is shown in the diagram below.

This curve captures the attributes of customers concerning behaviours that drive costs into the business. If we add to this data the attributes that conventional CRM captures about customers then we can get beyond revenue and gross margin and predict the real profitability (net margins) of customers based on a host of attributes. The marriage of cost information and marketing data is one made in heaven. But although they make a perfect couple, surprisingly it is only recently that the right combination of analytical tools have become available that work together with ease. Uncovering, simulating and predicting net margins provides the knowledge that will be the source of significant competitive differentiation.

And if this wasn't enough, an added benefit of the customer profitability analysis is that it highlights the costs of poorly designed internal processes. As the true costs of processes emerge, managers can sense which costs are suspiciously high. This triggers a cycle of further investigation, problem identification and process improvement, thereby correcting profit-harming defects that would otherwise continue undetected.

CRM undoubtedly leads to opportunities for revenue enhancement, but as net margins have little correlation with revenue or gross margins, CRM could risk cost escalation. For businesses with tight margins, understanding and controlling costs can have as much or more influence on profits as can increased revenues. Combining CRM with a clear understanding of how costs are driven in the business provides the winning formula. The devil of unprofitable customers is in the detail of the costs.